SideShift.ai Weekly Report | 12th - 18th August 2025

Welcome to the one hundred and sixty-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- XAI advanced +8.9% to a $24.91m market cap, marking its first clear move above $0.16 in two months.

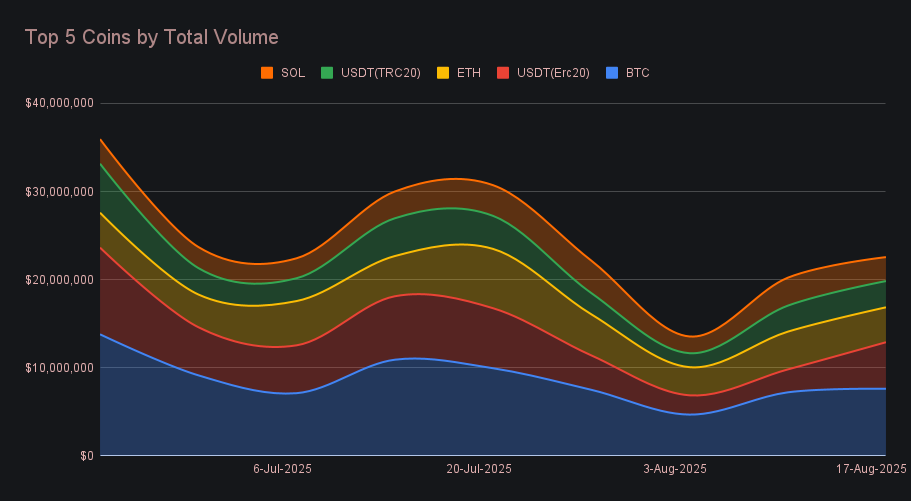

- SideShift volume rose +19.3% to $19.78m, with ETH/USDT (ERC-20) leading pairs for the first time on record.

- BTC posted $7.62m in total volume, continuing to anchor flows even as stablecoins have lately led settlements.

- Stablecoin activity topped $10m, paced by USDT (ERC-20) doubling; net flows of −$1.38m showed rotation back into stables.

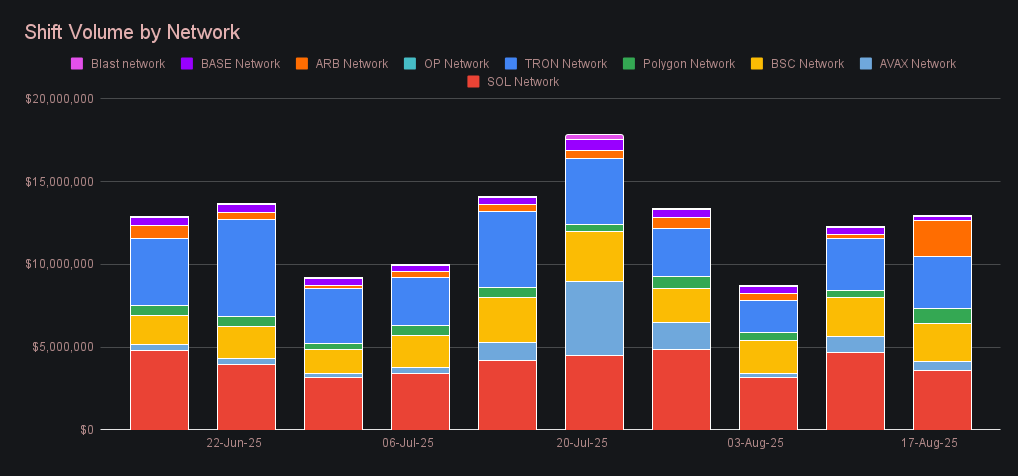

- Arbitrum surged +761% to $2.16m, while L-BTC jumped 18x to $2.45m on Liquid, both standout network performers.

XAI Weekly Performance & Staking

XAI pressed higher through the week, climbing in a steady upward channel from $0.1585 on August 12 to a high of $0.1677 on August 17, before settling at $0.1647 at the time of writing. The move stands out as the first meaningful upside push in over two months, as XAI had spent most of that time hovering near $0.15 with $0.16 repeatedly acting as resistance. The move left the token with an +8.87% rise in market cap, moving from $22.88m to $24.91m.

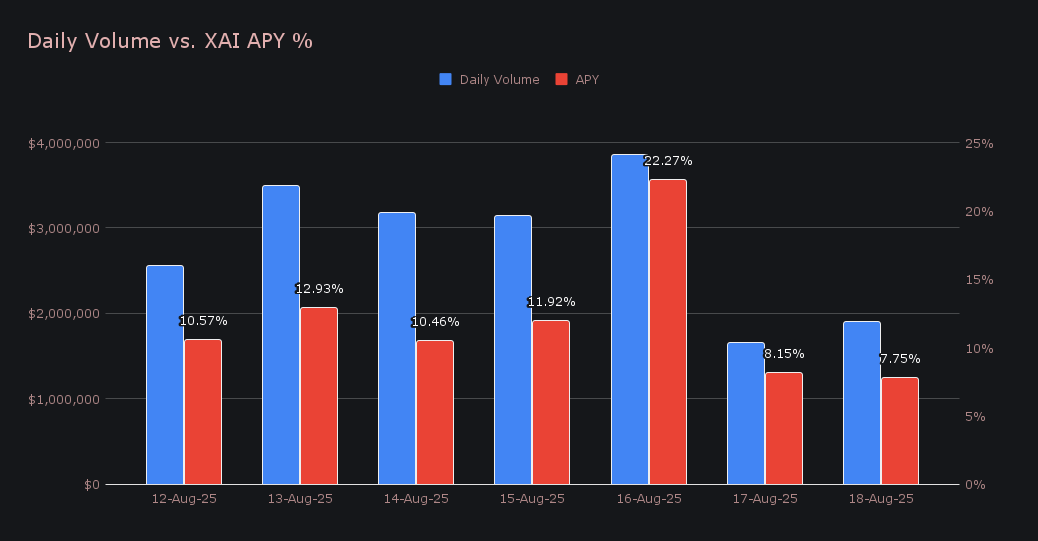

Staking activity also strengthened and mirrored the broader upswing in XAI’s price. A total of 297,682.35 XAI ($44,990.66) was distributed to stakers, with the average APY landing at 12.01%, representing an improvement on recent weeks. The standout day came on August 16, when 75,985.55 XAI was sent to the staking vault at a robust 22.27% APY, backed by $3.86m in daily shift volume.

SideShift’s treasury received an additional 200,000 USDC over the past week, bringing the current total to an estimated $30.31m. Users can follow along with live updates at sideshift.ai/treasury which provides full visibility of both our BTC treasury address and main EVM address.

Additional XAI updates:

Total Value Staked: 138,116,977 XAI (+0.4%)

Total Value Locked: $22,834,737 (+10.4%)

General Business News

August 14th saw BTC notch a new all-time high above $124k before momentum reversed and the price fell back toward $114k toward the end of the week, with a wave of liquidations accompanying the move lower. ETH also made headlines with its highest weekly close in four years at $4,475, boosted by strong ETF inflows and buzzing network activity. Fundstrat’s Tom Lee added to the spotlight by describing ETH as the “biggest trade” of the coming decade.

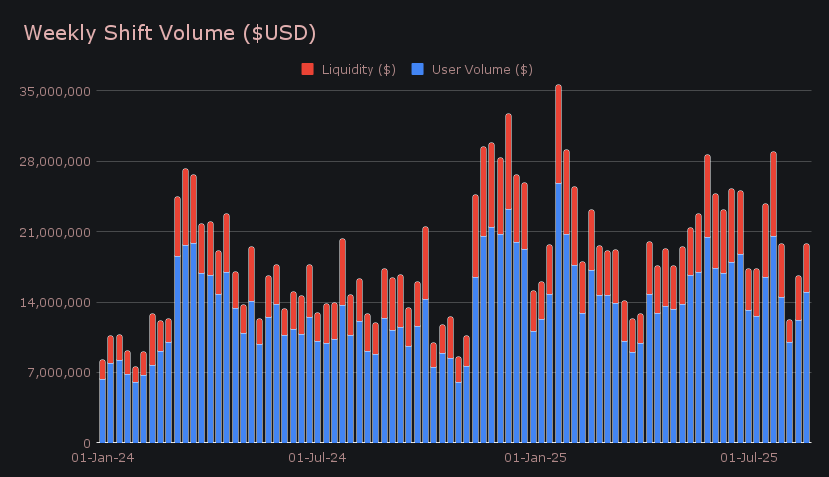

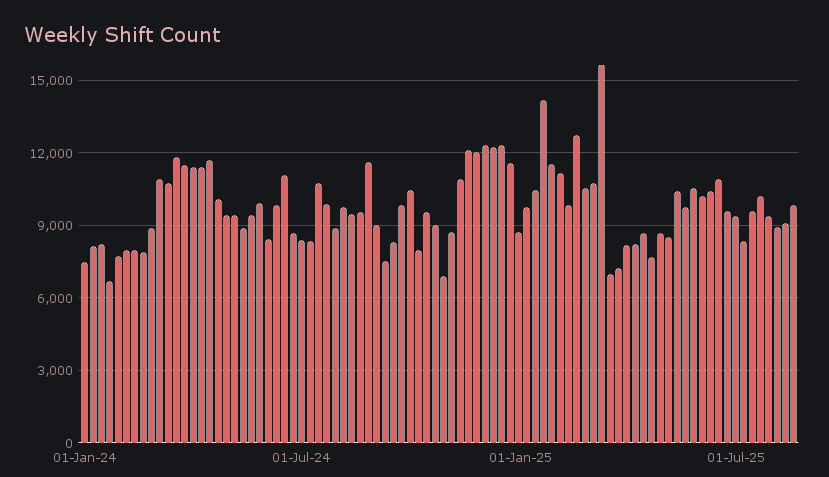

SideShift posted a gross weekly volume of $19.78m, climbing +19.3% from the prior week and marking the third straight period of growth. Activity has now returned to levels last seen at the end of July, with a bulk of the increase coming from shifts occurring directly on site across a mix of networks. Notably, it wasn’t just BTC or ETH driving flows — chains like Arbitrum and Liquid, which often see uneven week-to-week activity, made meaningful contributions this time around. Among user pairs, ETH/USDT (ERC-20) captured the top spot with $1.16m, the first time ever it has led since SideShift began recording pair popularity several years ago. It was followed by BTC/USDC (ERC-20) at $690k, and USDT (ERC-20)/L-BTC with $603k.

Gross weekly shift count rose to 9,796 (+7.9%), working out to an average of 1,399 shifts per day alongside a daily volume average of $2.83m. Both figures were essentially in line with our year-to-date averages, falling within just a few percent.

BTC remained at the forefront of activity on SideShift, recording $7.62m (+5.6%) in total volume (deposits + settlements) over the past 7-day stretch. User deposits rose to $3.17m (+26.7%), continuing a steady upward trend over the past three weeks alongside the broader volume increase, while settlements moved the opposite way, easing to $2.21m (-20.3%). This contrast was notable given that, for most of the year, BTC has dominated as the site’s most-settled coin, only in recent weeks ceding that position to stablecoins. Even so, BTC still continues to set the pace on SideShift, typically leading the way on one side of the shift or the other.

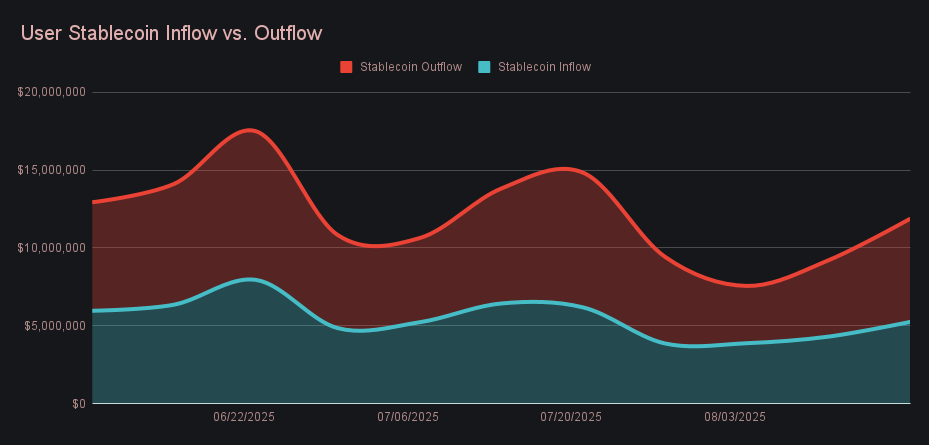

Stablecoins followed with sharply contrasting momentum. USDT (ERC-20) surged to $5.28m (+103.4%), the largest percentage gain among all top coins this week, with deposits rising to $1.55m (+44.8%) and user settlements more than doubling to $2.49m (+156.9%). By comparison, USDT (TRC-20) was steady at $2.98m (+0.9%), as a small gain in deposits (+4.9%) was offset by a slight decline in settlements (-3.5%). Collectively, stablecoin volume regained the $10m marker, a level last recorded a month ago. Net flows across all networks finished at - $1.38m, continuing the usual pattern of outflows exceeding inflows. That said, flows did briefly flash positive earlier in the month, signaling that users were rotating into risk assets and selling down stablecoins when the market dipped. Since then, the trend has decisively swung back in the other direction, with users selling into the safety of stablecoins as prices push toward all-time highs.

Rounding out the leaderboard, ETH recorded $3.96m (-7.5%) in total volume, with deposits climbing to $2.50m (+32.3%) but settlements falling sharply to $875k (-34.5%). The decline on mainnet Ethereum itself contrasted with activity elsewhere, as ETH volume on Arbitrum jumped from the mid-five figures to $866k, highlighting how L2 demand helped offset weakness seen on mainnet. SOL followed in fifth with $2.72m (-14.4%), as user deposits dropped to $588k (-48.3%) and settlements fell to $1.28m (-8.5%). While quieter compared to its peaks earlier this year, SOL maintained enough activity to remain among the week’s top coins.

Alternate networks to ETH pushed higher overall, with cumulative volume rising +5.7% to $12.95m. The Solana network remained in front at $3.58m (−23.2%), despite slipping from last week’s tally. Tron followed with $3.15m (+0.3%) as activity there was broadly unchanged, while the BSC network was close behind at $2.31m (−3.6%). Arbitrum stood out with an incredible surge to $2.16m (+761.3%), its strongest showing in months, and Polygon also more than doubled to $894k (+118.9%). In contrast, Avalanche declined to $549k (−43.2%) and Base fell to $251k (−37.3%). The Liquid network also put in a strong week, with L-BTC jumping 18x to $2.45m and L-USDT adding another $405k.

Affiliate News

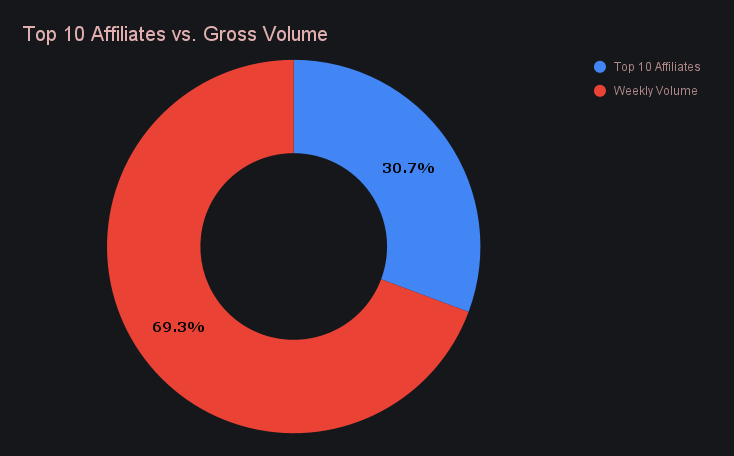

Affiliate activity closed the week at $6.07m, a +7.4% increase from the prior period. First place rose sharply to $2.15m (+68.4%), helping to lift the total and once again swapping positions with second place, which settled at $2.12m (−15.6%). Third place pulled back to $686k (−28.0%) but continues to command the highest shift count, recording 1,551 shifts to lead all affiliates.

Altogether, our top affiliates accounted for 30.7% of our total volume, -3.4% lower than last week's proportion, as overall site activity outpaced affiliate volume this week.

That’s all for now - thanks for reading and happy shifting.