SideShift.ai Weekly Report | 5th - 11th August 2025

Welcome to the one hundred and sixty-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

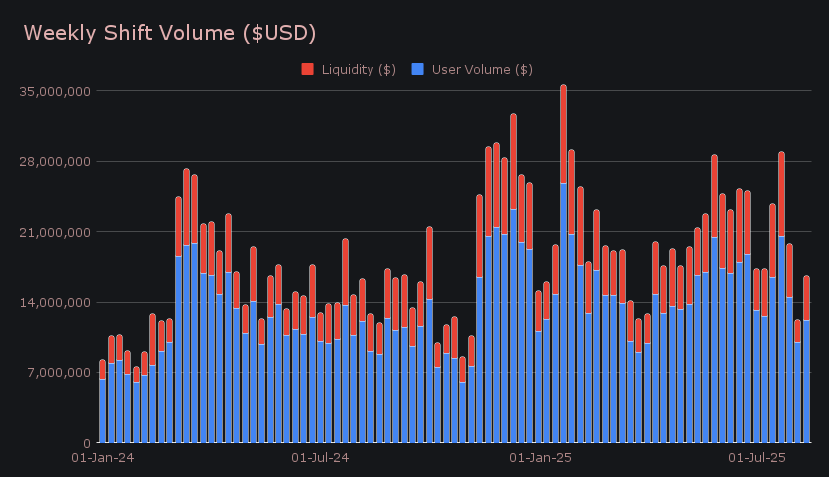

- SideShift volume rebounded +35.4% to $16.57m, with growth in both user and liquidity shifting after last week’s lull.

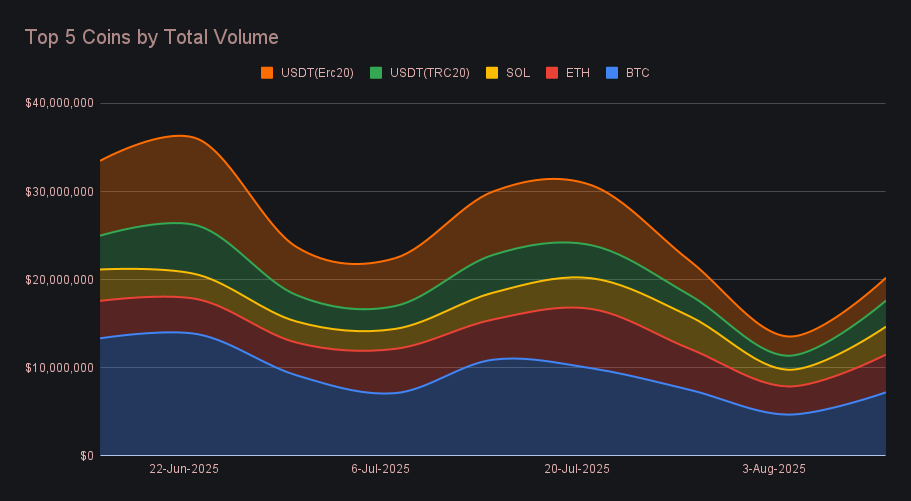

- USDT (TRC-20) posted the biggest gain among top coins, soaring +86.1% in weekly volume, while BTC (+53.8%) and SOL (+67.2%) also logged strong growth.

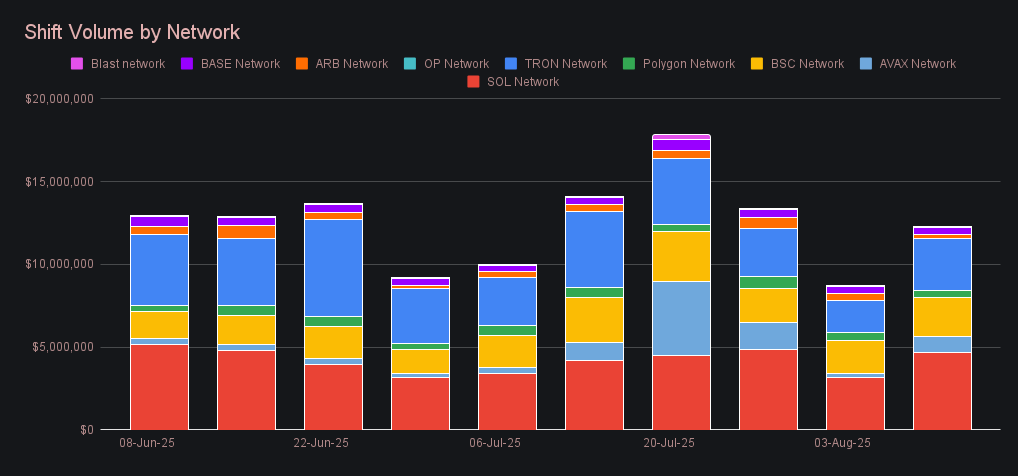

- Alt networks outpaced Ethereum’s +16.7% rise, led by Solana, Tron, and BSC — with BSC shifting now nearing the top two USDT variants.

- XAI price held steady at $0.1515, with staking yields and rewards slightly higher than last week’s totals.

- Top affiliate volume rose +26.8%, with first place reclaiming the crown and third place extending its growth streak.

XAI Weekly Performance & Staking

XAI spent the week moving in a tight band between $0.1487 and $0.1515, with a few brief dips toward the lower end before steadily reclaiming ground. Momentum built gradually over the past couple of days, leaving the token at $0.1515 at the time of writing. That puts the market cap at $22,881,127, a fractional −0.09% change from last week, effectively keeping things level in broader terms.

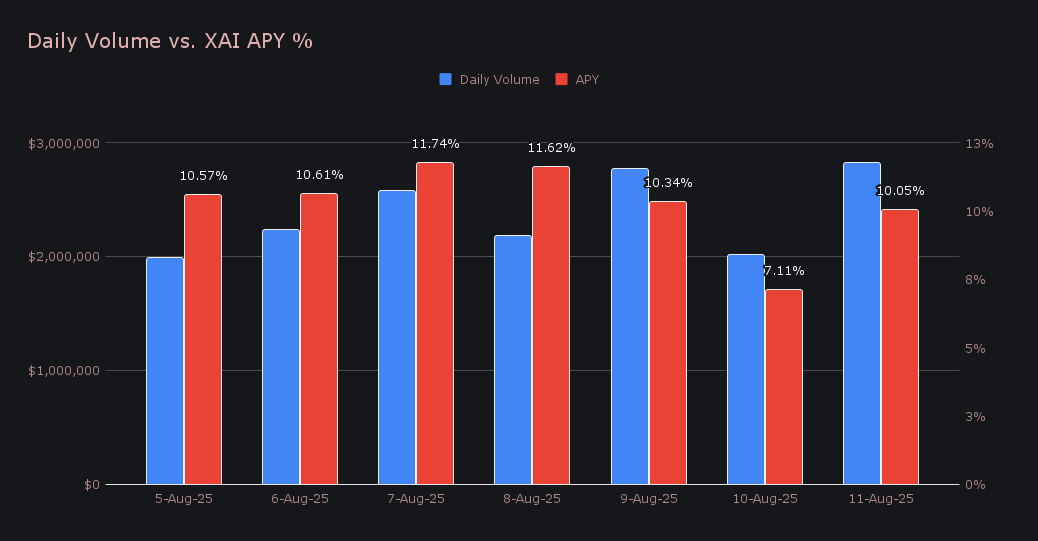

Staking yields were solid, with a total of 257,867.84 XAI ($38,958.08) distributed to stakers across the week. The average APY landed at 10.29%, while August 7th marked the standout day — 41,775.83 XAI was sent to the staking vault at 11.74% APY, backed by $2.57m in daily volume. Both the reward total and yields were slightly ahead of last week’s, suggesting a pickup in activity on the platform.

Additional XAI updates:

Total Value Staked: 137,596,872 XAI (+0.2%)

Total Value Locked: $20,687,938 (+0.1%)

General Business News

BTC surged back toward its all-time high this week, climbing above $122k before cooling slightly, leaving it less than 1% from the ~$123.2k peak. ETH touched $4k for the first time in months and, more importantly, broke through a resistance level that has held since 2021, pushing on to $4,350. Among top coins, Ethereum-based tokens Lido DAO (LDO) and Aerodrome Finance (AERO) led the gains, soaring +57.63% and +45.00%, respectively, adding to the network’s growing head of steam.

SideShift recorded a gross weekly volume of $16.57m, climbing +35.4% from the prior period. The bounceback was welcomed after last week’s mid-summer lull, with increases seen across both site shifting and most of our top integrations. User shifting volume rose to $12.24m (+21.9%), while liquidity shift volume nearly doubled to $4.33m. An interesting standout was the recurring top shift pair USDT (BSC)/BTC, which unexpectedly seized the top spot among users last week and retained it this week, followed by BTC/USDT (TRC-20) and USDT (ERC-20)/BTC. The continued dominance of BTC <> stablecoin pairs underscores their relevance, though the preferred stablecoin in these flows continues to shift.

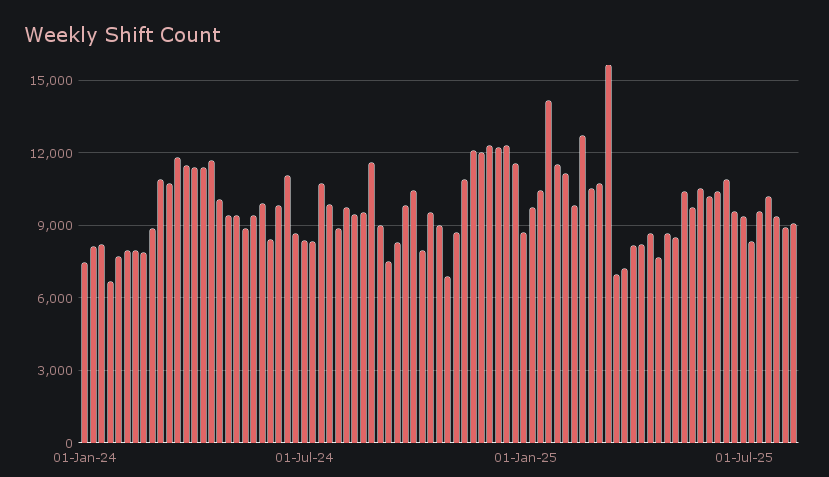

Our gross shift count totalled 9,077, an increase of +2.1% week-on-week. This worked out to a daily average of 1,297 shifts, pointing to steadier engagement compared to the sharper moves seen in volume. The relatively lower volatility in shift count versus volume suggests that recent market moves are prompting larger average shift sizes rather than a spike in the number of transactions.

BTC retained its position at the top of the leaderboard with $7.22m in total volume (deposits + settlements), a +53.8% jump from last week. User deposit volume climbed to $2.50m (+43.5%), while user settle volume rose to $2.78m (+33.9%), cementing its dominance in weekly activity as BTC’s ecosystem buzzes, with SideShift volumes climbing in step with the asset’s price hovering near all-time highs.

ETH ranked second with $4.29m in seven day total volume (+34.2%), logging $1.89m in deposits (+43.6%) and $1.34m in settlements (-11.7%). SOL followed at $3.17m, posting one of the largest percentage gains among top coins with +67.2% total volume growth, driven by $1.14m in deposits (+69.5%) and $1.40m in settlements (+40.3%). On SideShift, SOL logged the larger positive volume change between the two, even as market prices told a different story - ETH climbed strongly on the week while SOL’s price gains were more subdued.

Stablecoin activity completed this week’s top group, led by USDT (TRC-20) with $2.95m in total volume (+86.1%) led by a strong $1.47m in settlements (also +86.1%), underscoring growing demand for Tron-based USDT. In contrast, USDT (ERC-20) saw a more modest +18.6% rise in total volume to $2.60m, with deposits at $1.07m (+39.4%) but user settlements falling to just $970k (-8.8%). Notably, USDT volume on the BSC network has been steadily gaining traction and now sits just a stone’s throw away from these top two variants.

Beyond this week’s top 5 coins, several other assets saw meaningful action. ADA, XRP, and AVAX were among the most notable, each generating high six-figure volume and posting triple-digit price gains. Each has, at times, reached seven-figure territory individually, most recently in mid to late July, but never quite enough to break into the top 5. These trends reflect a broader pattern on SideShift, where a network’s native coin typically drives the majority of that chain’s volume — for instance, on Solana, SOL consistently outpaces USDC (SOL), although the stablecoin still sees solid, steady volume. When it isn’t the native coin leading, it is almost always a stablecoin on that chain rather than a token like LDO or AERO. The reverse dynamic, where a stablecoin consistently outperforms its native coin, is rare but does occur, most notably on Tron, where USDT (TRC-20) dominates while TRX trails behind.

Alternate networks to ETH enjoyed a strong rebound, with cumulative volume rising +41.3% to $12.25m. The Solana network led at $4.68m (+47.3%), marking one of its strongest tallies in recent weeks. The Tron network followed with $3.14m (+62.0%), pushing back toward the upper end of its recent range, while the BSC network reached $2.40m (+21.1%). The Avalanche network climbed to $966k (+303.3%), a sharp move higher but more in line with its occasional spikes earlier this summer rather than a return from any prolonged slump. Further down, Polygon slipped to $408k (−17.4%), Base was steady at $401k (−1.4%), and Arbitrum fell to $251k (−41.5%). The top three alt networks alone accounted for more than 85% of all non-Ethereum flows, leaving the rest to fight for a far smaller slice of the pie. Collectively, all of these alts outpaced the Ethereum network’s +16.7% growth, restoring their share to a level more typical of June and July’s cross-chain flows.

Affiliate News

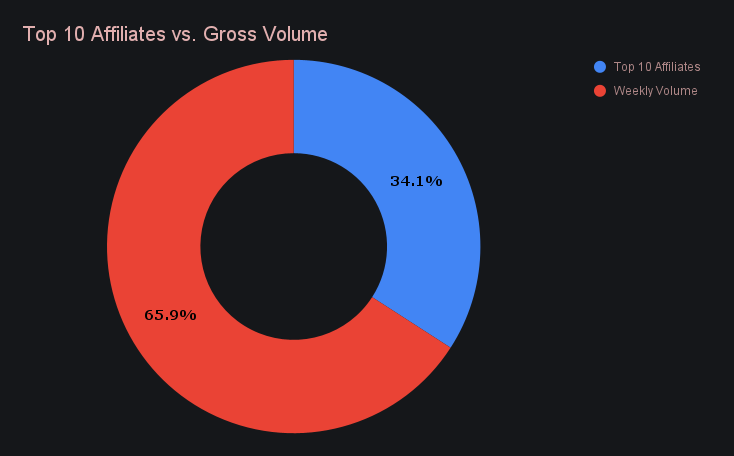

Volume from our top affiliates climbed to $5.65m, a +26.8% improvement from the prior 7 days. First place reclaimed its throne after being knocked down for the previous three, surging +80.5% to $2.51m. Second place was the lone laggard, easing −12.9% to $1.27m, still a healthy figure in the context of affiliate contributions. Third place has now grown in four straight periods, the only affiliate to do so, adding +25.5% to reach $952k. It also remains firmly in control of shift count among affiliates.

Collectively, all three accounted for 34.1% of total volume, down −2.3% from the week prior.

That’s all for now - thanks for reading and happy shifting.